By Shauna

June 17, 2022

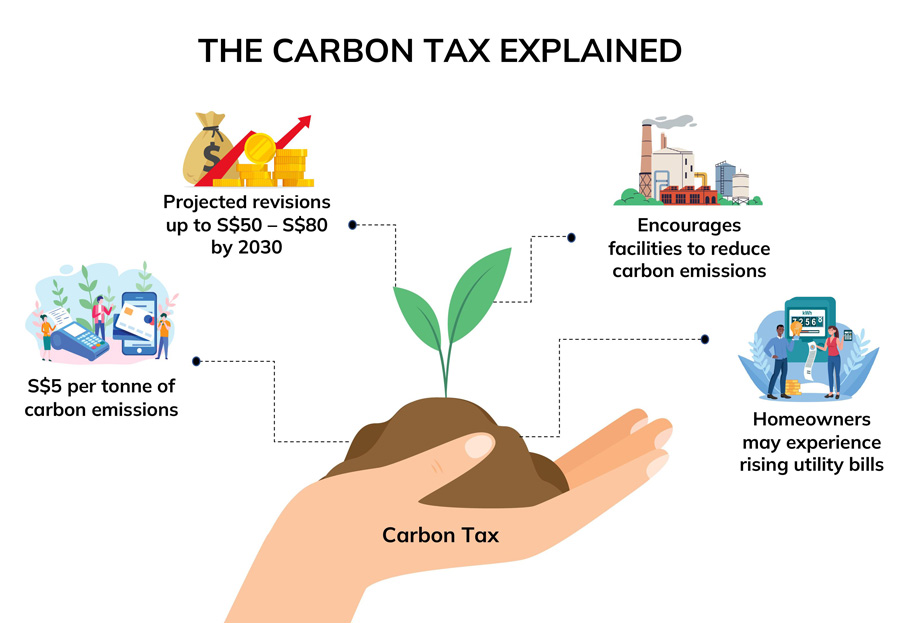

Internationally, there is increasing emphasis on climate change and more recently, on carbon pricing to combat it. In 2019, Singapore became the first Southeast Asian country to implement a carbon tax on carbon emissions. Yet, not many of us are aware of what a carbon tax is or what they entail.

We dive into and explore carbon pricing and the impacts it entails.

Placing A Price On Carbon: How Carbon Pricing Works

Carbon pricing is a policy tool that aims to reduce the amount of carbon dioxide released into the atmosphere by either imposing a fee or a cap on the amount of carbon dioxide emitted. In the case of Singapore, a Carbon Pricing Act was put into operation in 2019, with a carbon tax of S$5 per tonne of carbon emissions. This tax is applied to any industrial facility that emits direct greenhouse gas emissions equal to or above 2,000 tonnes of carbon emissions annually. In the near future, there are plans to gradually increase the carbon tax to S$50 – S$80 per tonne.

Projected Carbon Tax Increase In Singapore

Living With The Carbon Tax

Yet, while carbon pricing can lead to higher costs of production and costs of living, this is to incentivise decarbonisation efforts and reduce emissions.

In the case of corporations wanting to avoid these rising costs, there are two solutions – improving their energy efficiency strategy or switching to renewable energy sources.

1. Energy Efficient Strategies

Being more conscious of the company's energy consumption can help alleviate the rising costs because of the Carbon Pricing Act. Corporations can opt for energy efficiency solutions, such as streamlining energy consumed by air conditioning and lighting – which, on average, accounts for 70% of a building's energy consumption.

StorHub did just that. In 2021, EDP Renewables installed green energy systems at several StorHub self-storage facilities across Singapore. The green energy systems consist of smart air-conditioning systems, electric vehicle charging points, green roof and solar energy systems, and are split across nine of StorHub's thirteen facilities. These solutions will help StorHub in acting more sustainably and energy efficiently.

2. Switching to Renewable Energy Sources

Another alternative would be to generate one's own electricity to meet their energy needs – this can be done via renewable energy sources such as solar. Companies can opt to greenify their rooftops through a Solar Power Purchasing Agreement (PPA). With a solar PPA, companies can go green through a hassle-free experience.

A solar PPA with EDP Renewables consists of the following enticing benefits below.

- Zero Capital Investment: EDP Renewables will design and install the solar energy system with zero upfront costs. Companies would only have to pay for the energy they have used.

- Monitoring, Maintenance and Replacement: EDP Renewables will take care of monitoring, maintenance and replacement costs for any Solar PPA purchased. We will also ensure the solar panel system is operating at optimal levels during the contract duration in Singapore.

Climate change is undoubtedly one of the most serious challenges for the entire world. A carbon tax can eventually be an important part of any mitigation strategy—from new technologies to rethinking energy efficiency strategies to lifestyle changes. With time and with the active participation of organisations and consumers alike, can we truly start to see change for Mother Nature.

As carbon taxes directly price emissions, this provides incentives for such facilities to lessen their reliance on carbon-intense processes, leading to reductions in emissions. Aside from that, carbon pricing also encourages these facilities to include the deployment of low-carbon technology and improve their energy efficiency strategies. With these shifts in energy consumption patterns, it also encourages collective climate action against global warming.

Carbon Pricing And Its Impacts

With the implementation of a carbon tax, carbon intensive sectors, such as power generation companies (gencos), will be heavily impacted. And with more than 95 per cent of Singapore's electricity being generated by fossil fuels, the cost of production and operation for these companies would naturally surge.

As these gencos are expected to pass on some degree of their own tax burden through increased electricity tariffs, facilities in other sectors will indirectly face a carbon price on the electricity they consume as well. This higher production costs may also be passed onto households and consumers as other expenses such as retail, food and transport may also surge due to higher electricity bills.

On top of that, household electricity bills may also rise as a result. A S$25 carbon tax per tonne of emissions is expected to lead to an increase of about S$4 per month in utility bills, for an average household living in a four-room Housing and Development Board flat. While seemingly insignificant, this will rise along with the inflation of the carbon tax over time and add to an increased cost of living for households.