EDPR has traditionally remunerated its shareholders through ordinary dividends paid-out in cash, but with the aim to improve its shareholders’ remuneration structure and pursuing the trends followed by other listed companies, EDPR has decided to, instead of an ordinary dividend, introduce a more flexible option consisting of the attribution of new paid-up shares, although preserving its shareholders’ right to receive a cash remuneration if they prefer.

The EDPR Scrip Dividend Program is a shareholders’ remuneration mechanism that allows shareholders to receive new paid-up shares of EDPR, while maintaining their option to receive all or part of the compensation in cash, as they see fit.

The company shareholders will be allocated an amount of incorporation rights equivalent to the number of shares they hold. These rights will be tradable on the regulated market of Euronext Lisbon under the same conditions as the shares they arise from, for an agreed period of time to be determined by the Board of Directors. Once such period for the trading of incorporation rights has expired, the rights will automatically convert into new paid-up shares. The specific number of shares to be issued and the number of incorporation rights required for the subscription of one new share will depend on the share price of EDPR when the program is launched (final details will be released to the market once the program is approved by EDPR shareholders and launched by the Board Directors).

In this compensation system, shareholders have three different options to choose from:

The shareholder decides not to sell all or part of their incorporation rights, so at the end of the trading period the shareholder will receive a certain number of new paid-up shares corresponding to a certain number of incorporation rights held.

The amount of incorporation rights which will be required to be converted for shareholders to receive one share of EDPR will be subject to a decision of the Board of Directors after the approval of the program by the general shareholders meeting of EDPR.

The shareholder decides to sell all or part of their incorporation rights in the regulated market of Euronext Lisbon, receiving a compensation in cash for the sale of the incorporation rights equivalent to the trading price of such rights. Shareholders choosing this option will not receive a guaranteed fixed price from EDPR and incorporation rights acquired in the regulated market of Euronext Lisbon may not be sold on to EDPR.

Shareholders can combine any or all of the options mentioned above, keeping in mind the different tax treatments that each option receives. To be noted that the gross amount received in the first two options will be equivalent, as the company’s share price will be used to determine both the price for the purchase of the incorporation rights by EDPR and the number of new shares to be issued.

The information contained herein is merely presented for educational purposes and does not constitute information which must be mandatorily made available to investors under applicable law. Any decision to be taken by the shareholders of EDPR regarding the EDPR Scrip Dividend Program, should be made following the approval and publication of a document containing information on the number and nature of the shares and the reasons for and details of the attribution of incorporation rights, pursuant to the provision of article 1(5)(g) of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017.

The launch of the program shall be subject to approval from the shareholders of EDPR in the annual general shareholders meeting. Final terms for the implementation of the EDPR Scrip Dividend Program, including the date for the launch of the program, as well as the maximum number of new shares to be issued and the price payable by EDPR for the incorporation rights shall be subject to approval by the Board of Directors.

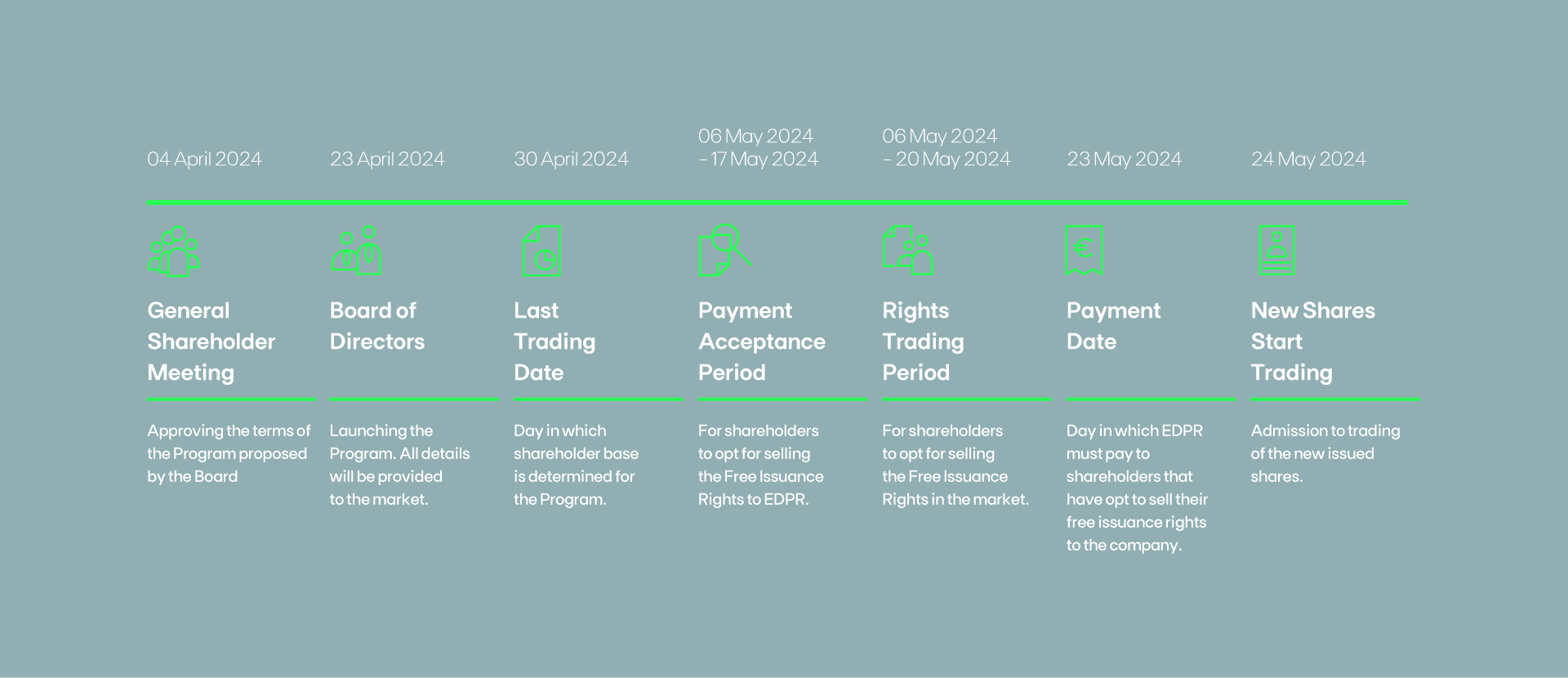

The timeline for the 2023 EDPR Scrip Dividend program will be disclosed at the moment of launch of the program.

Timeline for the 2023 EDPR Scrip Dividend Program

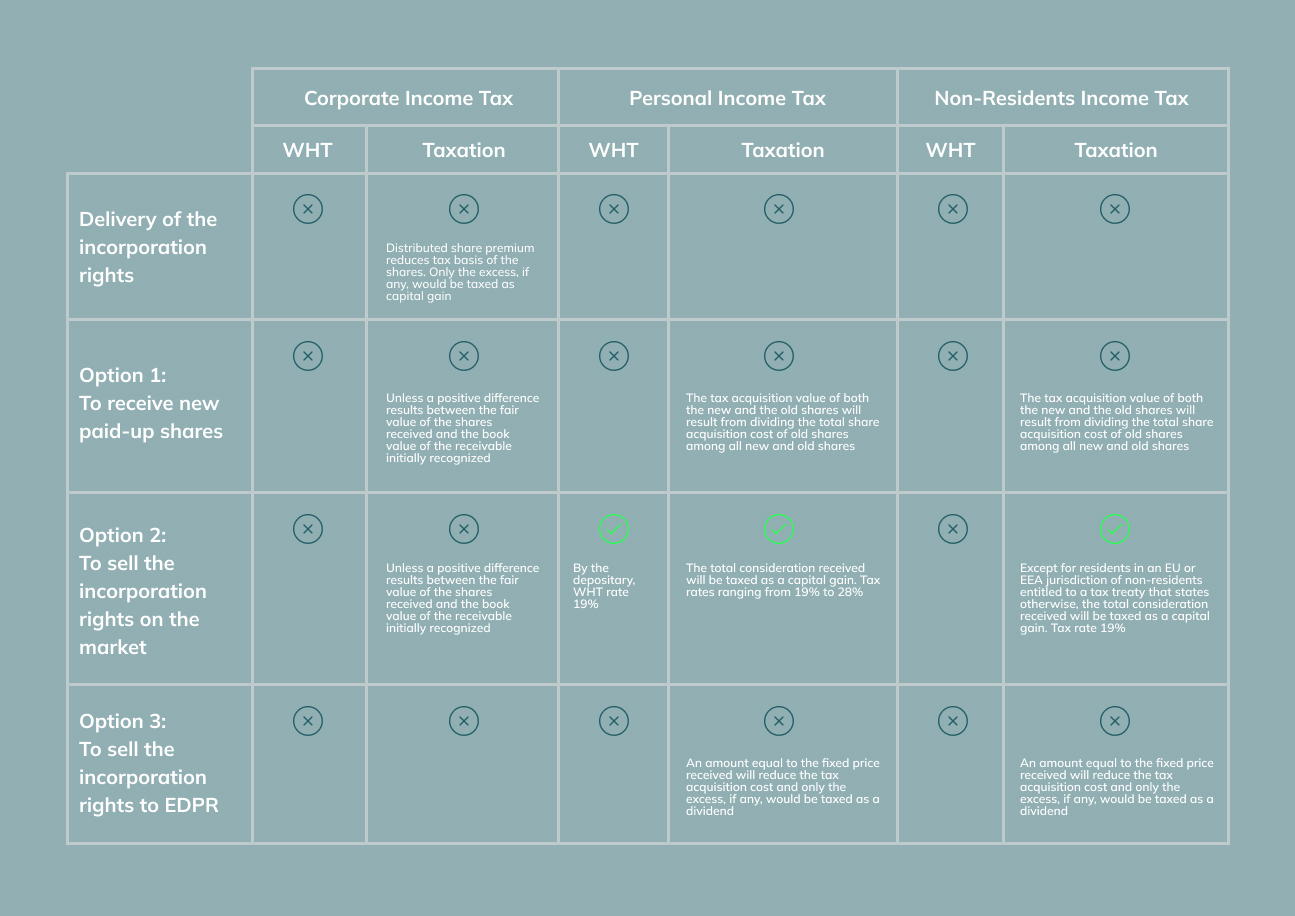

The taxation in relation to each of the available alternatives is set out in the directors' report that is published in the general shareholders meeting announcement and it is also available in the report published prior to the start of the program.

What is the intention of this program?

EDPR has decided to replace its ordinary dividend policy with this new program in order to improve the shareholder remuneration structure and give shareholders the opportunity to receive shares from the company, while still maintaining the option of receiving their compensation in cash.

What should I do if I want to receive my dividend as usual in cash?

In order to receive your remuneration in cash, as a shareholder you can sell your incorporation rights to EDPR for a fixed price (to be approved and communicated in advance of the commencement of the program) or trade them in the regulated market of Euronext Lisbon.

What should I do If I want to receive newly issued paid-up shares?

In order to receive new paid-up shares of EDPR, as a shareholder you do not have to do anything. Once the trading period has finished, the incorporation rights automatically convert into new paid-up shares. The amount of incorporation rights required to be converted for shareholders to receive one share of EDPR is subject to a decision of the Board of Directors, after the approval of the program by the general shareholders meeting of EDPR.

Can I decide to receive some of my remuneration in cash and some in shares?

Yes, as a shareholder of EDPR you can combine any or all the alternatives available in the program to receive part in cash and part in shares.

What will happen if in the end I do not make any decision and I do not communicate anything to my financial intermediary?

If you do not communicate any option to your financial intermediary, your incorporation rights will automatically convert into new paid-up shares once the trading period has finalised. The amount of incorporation rights required to be converted for shareholders to receive one share of EDPR is subject to a decision of the Board of Directors after the approval of the program by the general shareholders meeting of EDPR.

Please note that you may receive a number of incorporation rights which does not entitle you to receive a number of shares of EDPR corresponding to a whole number. In that case, and in the event that you opt to receive new shares, to avoid losing the remaining incorporation rights you are required to order your financial intermediary to, either (i) sell said incorporation rights to EDPR or in the regulated market of Euronext Lisbon or (ii) acquire a number of incorporation rights in the regulated market of Euronext Lisbon which would allow you to subscribe an additional new share.

How many incorporation rights will I receive for each share I own?

Shareholders shall receive a number of incorporation rights equal to the number of shares they hold at the time the Board of Directors resolves to launch the program, following the approval of the program by the general shareholders meeting of EDPR.

How many incorporation rights will I need to receive a new paid-up share?

The setting of the number of incorporation rights which will be required to be converted for shareholders to receive one share of EDPR will be subject to a decision of the trading price of the EDPR share the days prior to the Board of Directors of EDPR resolves to launch the program, following the approval of the program by the general shareholders meeting of EDPR. This information will be released to the public and included in the informative document to be made available to investors under applicable law.

Can I buy more rights if I wish to receive more shares than I am entitled to?

Yes, you can buy incorporation rights in the regulated market of Euronext Lisbon in order to receive additional new paid-up shares.

What happens with the rights that are not enough to receive a new paid-up share?

You may sell your incorporation rights in the regulated market of Euronext Lisbon and receive a cash consideration. You may also instruct your financial intermediary to sell those rights to EDPR for a fixed price. If you do not do either those things, such rights will be forfeited and you will receive no compensation (in cash or in shares) in relation to them.